Redefine Your Career in Real Estate With Unmatched GCI Up to 140% Commissions

Agents PRO, GTR, ORRA, RASM

Be More Than an A Real Estate Agent — Be a Financing Pro Too!

At MC Homes Realty, we’re redefining what it means to be a real estate agent. Our RE + MLO program creates a new breed of agents who are fully trained and licensed not only as real estate professionals but also as Mortgage Loan Officers (MLOs).

This unique combination gives you the ability to provide financing to your buyers, offering all types of loans for both residential and commercial real estate — all while keeping 100% of your real estate commission and earning 25%-40% of mortgage commissions.

Here’s what makes RE + MLO different:

Complete MLO Training: We’ll guide you through the process of getting your MLO license, covering all expenses (reimburse), including 3 days of classes, the state exam, and license fees up to $500.

Dual Expertise: As an RE + MLO, you can help buyers secure financing directly, closing deals faster and offering a one-stop-shop experience for your clients.

Residential & Commercial Financing: Whether it’s a home loan or a commercial real estate investment, you’ll have the ability to offer diverse financing options, expanding your business reach.

MC Homes Realty is the future of real estate, and we’re excited to build a community of agents who can provide more value and earn more — all while leading the market in real estate and mortgage financing.

Ready to elevate your career? Join our RE + MLO program today and become a true real estate professional with the power of mortgage financing in your hands!

How My Mortgage License Changed Everything

Choose Your Plan

RE + MLO

100% Commission (real)

$0 Monthly Fee

$0 Transaction Fee

+ 25%-40% Mortgage Commission

25%-40% Mortgage Commission

No Hidden Fees

Dedicated Support Line

Transaction Management

Real Estate & Mortgages CRM

Agent Website with IDX Feed

Education & Training

Access to Mentorship Program

Website Lead Program

OpCity Leads

$0 E&O per file

REQUIREMENT: Become an MLO or Mortgage Loan Officer with Generation Mortgage Associates, MC Homes sister company. We will reimburse up to $500 to cover your 3 days classes, State exam, and license!

no monthly fee

$0 Monthly Fee

$300 Transaction Fee

No Hidden Fees

Dedicated Support Line

Transaction Management

Real Estate CRM

Agent Website with IDX Feed

Education & Training

Access to Mentorship Program

Website Lead Program

OpCity Leads

$35 E&O per file

basic plan

$49 Monthly Fee

$149 Transaction Fee

No Hidden Fees

Dedicated Support Line

Transaction Management

Real Estate CRM

Agent Website with IDX Feed

Education & Training

Access to Mentorship Program

$35 E&O per file

MC Homes Realty Inc. — Where Agents Thrive

Since 2004, MC Homes Realty Inc. Real Estate Group has been redefining what it means to be a successful real estate agent in Florida. Our mission is simple: empower agents to build their business their way — from home, on their schedule, without high desk fees or commission splits.

We focus exclusively on our local market, giving our agents the knowledge, tools, and support they need to excel. Through top-tier training, cutting-edge technology, and a culture of collaboration, we create an environment where agents can maximize their earning potential, grow their careers, and make a real impact in the communities they serve.

At MC Homes Realty, we’re not just building a brokerage — we’re building a new generation of agents who are free to succeed on their terms.

Maggie Caceres

Real Estate Broker

Mortgage Loan Officer - MLO

Licensed Community Association Manager - LCAM

Sell Homes. Offer Loans. Earn More.

Get Started Today!

MC Homes Realty — Where agents thrive, careers grow, and opportunities don’t exist anywhere else. Your future starts now.

Multiple Benefits With MC Homes!

Making Extra Income Has Never Been Easier

How I Increased My GCI by 40%

Freedom, Flexibility & Unlimited Potential

Real Estate + Loans = More Commissions.

Get Started Today!

MC Homes Realty — Where agents thrive, careers grow, and opportunities don’t exist anywhere else. Your future starts now.

Testimonials

Joining MC Homes Realty was the easiest way for me to increase my GCI — now I keep 100% of my real estate commissions and earn an extra 40% from mortgage commissions. I can focus on representing my buyers while also offering them a mortgage loan, without any learning curve. The best part? My office handles the entire loan process, making it simple, seamless, and profitable!

elena briand

I love the commission structure, compliance support, and valuable mortgage connections that MC Homes Realty provides. But what sets this brokerage apart is the incredible team of experts who are always available to answer any question and provide the support I need to tackle new challenges.

iSABEL ARANGO

Join MC Homes Realty — The New Breed of Agents.

Frequently Asked Questions

Sell Homes. Offer Loans. Earn More.”

How much I will received for a $500,000 transaction?

Let’s calculate this step by step carefully:

🏠 Real Estate Side (100% Commission)

Home price: $500,000

Commission rate: 3%

3% of $500,000 = $15,000

✅ You receive 100%, so you collect:

👉 $15,000 from the real estate side

💰 Mortgage Side (40% of 2.75%)

Loan amount: $475,000

Lender pays: 2.75% commission

2.75% of $475,000 = $13,062.50

You receive 40% of that:

40% × $13,062.50 = $5,225.00

✅ You collect $5,225 from the mortgage side

💵 Total Commission Earned

Real Estate Commission: $15,000

Mortgage Commission: $5,225

Total = $15,000 + $5,225 = $20,225

You just turned a 3% commission into the equivalent of 4.05% total commission on the same transaction — without any additional clients or listings.

Are you affiliated with any professional associations?

Yes. MC Homes Realty is proudly registered with some of Florida’s leading associations, including:

-PRO (Pinellas Realtor Organization)

-GTR (Greater Tampa Realtors)

-ORRA (Orlando Regional Realtor Association)

-RASM (Realtor Association of Sarasota and Manatee)

These partnerships give our agents credibility, professional resources, and local market support.

What makes MC Homes Realty different from other brokerages?

At MC Homes Realty, we’ve redefined what it means to be a real estate agent. We offer up to 140% commissions, with no desk fees, no monthly fees, and no transaction fees.

You keep 100% of your real estate commissions, plus 25%-40% of the mortgage commissions when you represent a buyer through our exclusive RE + MLO program.

We also provide top-tier training, technology, and full support, allowing you to grow your business your way — from home or on the go.

$0 Setup

$0 Monthly fees

$0 Transaction Fees

You get the entire commission check 100% - If your commission is $15,000 you get $15,000

No — there are no monthly or transaction fees at MC Homes Realty.

We’ve removed the financial barriers that hold agents back. You’ll have access to all the systems, training, and support you need to succeed without paying extra.

What is the RE + MLO program?

Our RE + MLO program creates a new breed of agents — professionals who are both licensed real estate agents and Mortgage Loan Officers (MLOs).

This means you can offer financing directly to your clients, making the process smoother and more profitable. You’ll have the power to handle both the real estate sale and the mortgage side, earning from both.

In-House Lending Partnership

MC Homes Realty, Inc. has proudly partnered with Generation Mortgage Associates and Commercial Loans Florida to offer a full range of residential and commercial loans in-house.

Through this partnership, our agents can now serve their clients more completely — handling both the real estate transaction and the financing under one roof.

By obtaining your MLO (Mortgage Loan Originator) or Mortgage Broker License — which can be completed in just a weekend class — you’ll be legally eligible to earn commissions from the mortgage side in addition to your real estate commissions.

And here’s the best part: after your first closing, we’ll reimburse you up to $500 for your licensing expenses, including class tuition, state exam fees, fingerprints, background check, and credit report.

At MC Homes Realty, we make it easy — and rewarding — for agents to expand their income and offer clients a complete real estate and financing solution.

I’m not a licensed Mortgage Loan Officer (MLO). Can I still join?

Absolutely! If you’re not yet an MLO, we’ll help you get licensed — and we’ll refund your costs.

We cover your 3 days of classes, state exam fees, and licensing costs up to $500. Our team will guide you every step of the way so you can start earning faster with no extra financial burden.

How much can I really earn at MC Homes Realty?

Our agents earn up to 140% in GCI (Gross Commission Income) — a level of income potential unmatched in the industry.

You’ll receive 100% of your real estate commissions, plus an additional 25%-40% of mortgage commissions on buyer-side deals.

With no hidden fees or splits, you’ll finally keep what you’ve worked for.

Do I have to work from the office?

No — we’re a virtual brokerage model, which means you can work from anywhere.

You’ll still receive full access to training, mentoring, and support, along with all the tools you need to manage your business efficiently and professionally.

What types of loans can I offer as an MLO?

We offer all type of loans for residential and commercial properties.

🏡 1. Conventional Loans

These are the most common loans not insured or guaranteed by the government.

Conventional Conforming Loan (meets Fannie Mae & Freddie Mac limits)

Conventional Non-Conforming (Jumbo Loan) — exceeds Fannie/Freddie limits

Fixed-Rate Mortgage (FRM) — interest rate stays the same for the entire term

Adjustable-Rate Mortgage (ARM) — rate adjusts periodically (e.g., 5/1 ARM, 7/1 ARM)

Interest-Only Mortgage — pay only interest for an initial period, then principal + interest

Balloon Mortgage — low initial payments with a large lump sum due at the end

Portfolio Loans — held by the lender instead of being sold to investors

🏠 2. Government-Backed Loans

Loans insured or guaranteed by federal agencies — great for first-time buyers or lower credit borrowers.

FHA Loans (Federal Housing Administration)

Low down payment (as little as 3.5%)

Flexible credit requirements

Popular for first-time buyers

VA Loans (Department of Veterans Affairs)

For eligible veterans, active-duty service members, and some surviving spouses

0% down payment

No private mortgage insurance (PMI)

USDA Loans (U.S. Department of Agriculture)

For rural and some suburban properties

0% down payment for eligible buyers

Income and property location restrictions apply

🏘️ 3. Specialty Conventional Programs

Created to help certain borrower profiles or property types.

HomeReady® (Fannie Mae) — for low-income borrowers with flexible credit and income sources

Home Possible® (Freddie Mac) — similar to HomeReady for moderate-income borrowers

Renovation Loans (e.g., Fannie Mae HomeStyle®, Freddie Mac CHOICERenovation®) — finance purchase + renovation costs

Energy-Efficient Mortgage (EEM) — finances energy upgrades with the home loan

Community Seconds® — down payment assistance programs paired with first mortgages

🏡 4. Non-QM (Non-Qualified Mortgage) Loans

For borrowers who don’t fit traditional income or documentation requirements.

Bank Statement Loans — qualify using bank deposits instead of W-2s

Stated Income / Stated Asset Loans — for self-employed borrowers

1099 Income Loans — use contractor or gig income documentation

DSCR Loans (Debt Service Coverage Ratio) — for investors qualifying based on rental income

Asset Depletion Loans — qualify using savings, investments, or retirement accounts

Foreign National Loans — for non-U.S. residents buying in the U.S.

🏠 5. Construction and Renovation Loans

For building or remodeling homes.

Construction-to-Permanent Loan — combines construction financing and long-term mortgage

Owner-Builder Loans — for borrowers acting as their own general contractor

Renovation / Rehab Loans — such as FHA 203(k) or Fannie Mae HomeStyle® Renovation

🏡 6. Reverse Mortgages (for Seniors 62+)

HECM (Home Equity Conversion Mortgage) — FHA-insured reverse mortgage allowing homeowners 62+ to convert equity into cash

🏘️ 7. Investment Property Loans

Conventional Investment Loan — higher rates/down payments for rental properties

DSCR Loans — qualify based on rental income (popular with investors)

Portfolio or Private Investor Loans — flexible underwriting for multiple properties

🏠 8. Other Niche / Alternative Loan Types

Bridge Loan — short-term loan to “bridge” buying a new home before selling an existing one

Second Mortgage / Home Equity Loan — lump sum based on existing home equity

HELOC (Home Equity Line of Credit) — revolving credit line using home equity

Buydown Mortgage (2-1 or 3-2-1) — temporarily lower interest rate for first few years

Assumable Loans — buyer takes over seller’s mortgage (common with FHA and VA loans)

Who handles the mortgage loan processing?

Our in-house mortgage team handles the entire loan process from start to finish — so you can focus on what you do best: helping your clients find their dream home.

You simply refer your buyer, and our licensed loan experts take care of the paperwork, approvals, and compliance, ensuring a smooth and timely closing.

You earn a generous commission share without the extra workload.

Here’s how it works:

💼 Earn 25% — When you take the initial loan application and collect your client’s income documents, our processing department will contact your client and handles the rest, managing all communication with underwriters and lenders through closing.

🚀 Earn 40% — In addition to taking the application, you serve as the main point of contact between your client and our processing team. You help collect any additional documents needed throughout the loan process, while our office takes care of all approvals and compliance.

Either way, you earn more — with full professional support and no added stress.

That’s the power of the RE + MLO advantage at MC Homes Realty.

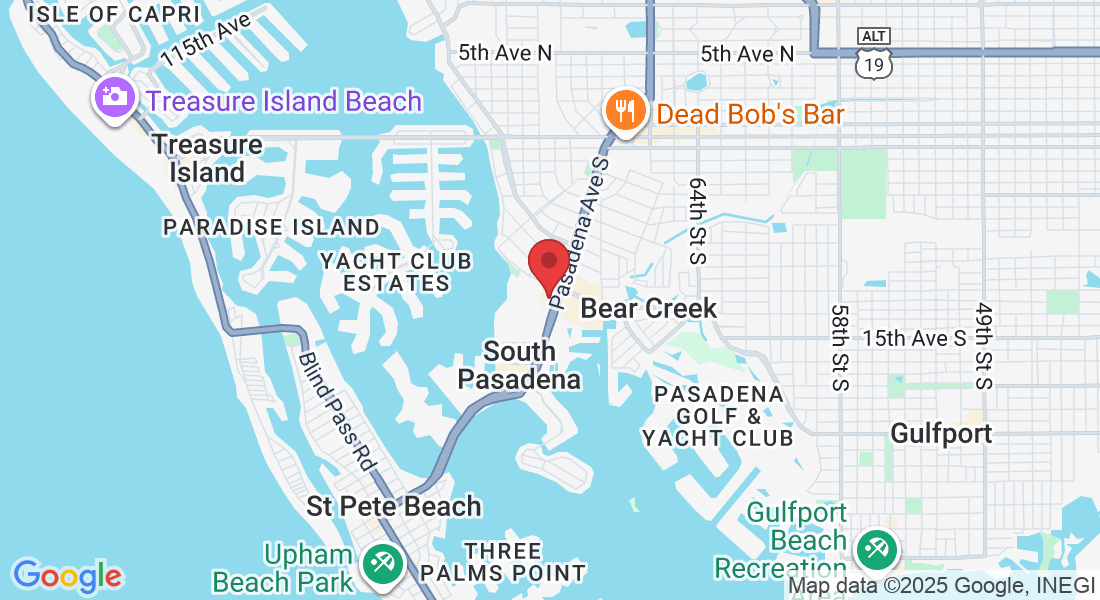

Need a space to meet clients or get some work done?

Our South Pasadena office is always open — with a conference room and computers available for agent use.

1155 South Pasadena Ave - Suite H

South Pasadena, FL 33707

(10 minutes from the Tyrone Mall in St Pete)

Never Lose a Buyer Because of Low Credit Scores

If your buyer doesn’t qualify today — don’t worry!

We will work closely with your clients who have low or challenged credit scores to help them get mortgage-ready.

Our credit improvement team will guide them step-by-step, showing them exactly what to do to raise their scores and qualify for financing. Once your client reaches the required credit level, we’ll notify you immediately so you can start showing them homes and getting their deal closed.

✅ You keep the client.

✅ We help them qualify.

✅ Everyone wins.

Get In Touch

Office Hours

Mon – Fri 10:00am – 5:00pm

Saturday

Sunday – CLOSED

Phone Number:

(727) 642-1166

1155 Pasadena Ave S

Suite H

South Pasadena, FL 33707

(727) 642-1166

www.mchomesrealty.com